The Complete Starter Guide to Making Money with Stock Options

Few people would argue with the millionaire’s number-one rule: Have multiple streams of income and make most (if not all) of them passive.

But these days, the same tenet holds true for basic financial solvency. New interest rates on savings and money market accounts are in the red. Why? Well, when you balance the return on most savings account (somewhere around .10%) with the price of inflation (roughly 2%), you get … less than no return.

Instead of sticking your hard-earned income under a glorified mattress, then, why not earn steady income by selling stock options?

I know what you’re thinking. Options are risky—Warren Buffett even called them “weapons of mass financial destruction.”

But he said this while also raking in billions of dollars using options strategies.

Here’s the rub: The safe way to make money on stock options involves patience. If you’re looking for big, quick gains using this strategy, you’ll have to look elsewhere.

For most of us, however, a reliable 10-15% annualized return is worth a little bit of leg work now and then—and stock options can give you that.

How it works

Some investors use stock option strategies as an insurance policy to protect their portfolio from losses. As the market climbs and dips, these investors look to maximize their profits and minimize losses. They accomplish the former (maximizing profits) by studying the market and picking stocks that they think have huge growth potential.

But even with that potential, the complicated variables impacting the market will sometimes drop these stocks far below the original purchase price—giving investors a huge loss.

That’s when stock option strategies for minimizing losses come in. To keep their losses at a minimum, investors will buy what are known as “puts” on certain stock. The put price—also known as a strike price—gives them the option to sell their stock at a set price by a set time, potentially precluding a huge loss in stock value.

But buyers need to buy puts from sellers—and that’s where you come in.

Anybody can sell puts—all you need is a brokerage account. These days, most of us access these accounts online. And while we’re all relatively familiar with the idea of buying and selling stocks online, few of us know that we also have access to stock options.

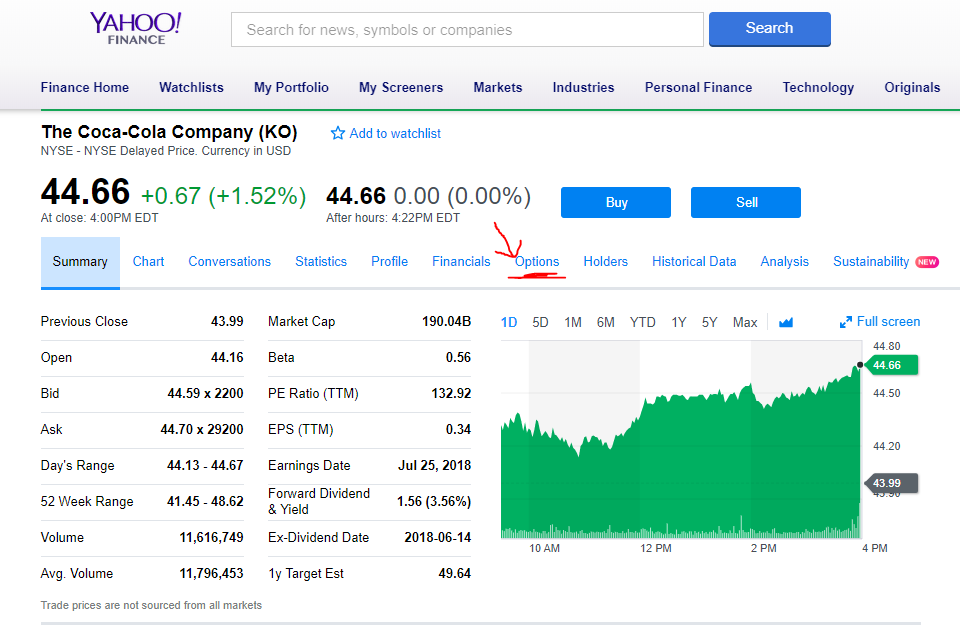

Here’s how you get started: After filling out an application to trade options (which will be approved for anyone who has the assets to trade), all you have to do is search for your stock’s ticker symbol, then once selected, review the charts, stats, and news about your stock. Based on this information, choose a strike price (bid) you’d be comfortable owning the stock at with an expiration date within your desired timeframe. I prefer expiration dates no more than two months out. Any further out and means more time for bad things to happen in the economy and the stock to drop.

After the bid is placed, an anonymous buyer will then buy your put and you’re in business!

A look at a brokerage account dashboard with “options” highlighted

Let’s walk through an example.

Let’s say you have $10,000 in your brokerage account and you want to try this put selling idea.

Once you’re in your account dashboard, you select “Options Chain” and decide to put up a bid for XYZ stock. Let’s say the current per-share price for XYZ stock is $20, so you offer a lower bid of $15 for a single contract of 100 shares. Why? Because XYZ is a company you genuinely want to invest in and you’re willing to bid $15 to own it.

This means that any buyer, when they buy your put at the strike price of $15, will have the option (but not the obligation) to sell you 100 shares of XYZ stock if the market price falls below $15 per share before August 30. This allows them to minimize their potential losses during the stock dive.

If, however, the stock price remains above the share price and the buyer doesn’t opt to sell their shares, the bid will expire.

If the buyer chooses to exercise the stock option contract, you, as the seller of the put, you are obligated to buy their shares. In the example above, you’d be the proud new owner of 100 shares of XYZ stock.

Whether you, as the seller, end up collecting shares in the transaction or not, you get paid a premium (fee) by the put buyer for offering them this insurance policy. Typically, the premium is a small percentage of the per-share bid you sold.

So how do you make money?

By collecting premiums, for starters. But you can also turn around and sell stock you’ve collected in put sales when the market rises again (known as a covered call)—making a profit on shares you purchased at a very low price. Or, you can simply use this added money in your brokerage account to sell more puts.

A couple of things to keep in mind, however:

- I recommend that you never engage in anything other than cash-covered put sales. In other words, if you have $10,000 in your brokerage account, don’t put up a bid for any stock that would cost you $10,001 or more. Work within your means.

- Because it’s possible you will acquire stock when selling puts, only target big, financially safe companies with established products or services whose stock you would want to own. Stay away from small, volatile stock that could tank.

I’m intrigued. Where do I start?

As mentioned above, working within your brokerage account is the easiest way to get started selling puts and working with stock options. Fill out an application to trade options, and once it’s approved, you can begin selling.

If you need more guidance, with stock options, subscribe to my newsletter by visiting thechampioninvestor.com. I regularly share insights for new and seasoned investors.

#

While stock options are a great source of passive income, it’s important to remember that they won’t get you rich quickly. Get in to the game for the longterm, and reduce risk by focusing on moderate annualized returns. As time goes on, you’ll see your monthly income grow by thousands of dollars—without the big risk of traditional trading.

[Investment advice in this article is used at the reader’s discretion. Early to Rise and Chad Champion cannot be held liable for individuals’ investment decisions. Always consult with a financial/investment expert before making these decisions.]

No passive income stream—however straightforward—happens without a routine that builds the foundation. Start with this wealth-building Morning Routine…

Sign up now to get our FREE Morning Routine guide—the #1 way to increase productivity, energy, and focus for profitable days. Used by thousands of fitness, business, and finance industry leaders to leapfrog the competition while making time for the people who really matter. Learn more here.